🌍 Mid-2025 Checkpoint: MOVE London, AMEXCAP EU, AaaS on the Rise, IPOs Reopen — What’s Next for Mobility?

From scouting startups in London to tracking market shifts — here’s what’s shaping the second half of 2025. Keep reading for our take, next steps, and what’s ahead.

Welcome to The Paddock, your go-to place for the latest insights and trends revolutionizing the mobility sector globally. 🚗

— Curated by Rodolfo, Enrique, Gastón, Cecy, Bernardo and Rodrigo: the Proeza Ventures team. 💪

📌 Do you know a startup reshaping mobility by being more efficient, safer and environmentally friendly? We want to meet them! 📩

🏁 Check our investment thesis and learn more about our Portfolio Co.

🪩 Proeza Ventures Spotlight

On the Road with Proeza Ventures: Investing in the Future of Mobility and Mexico 🌍

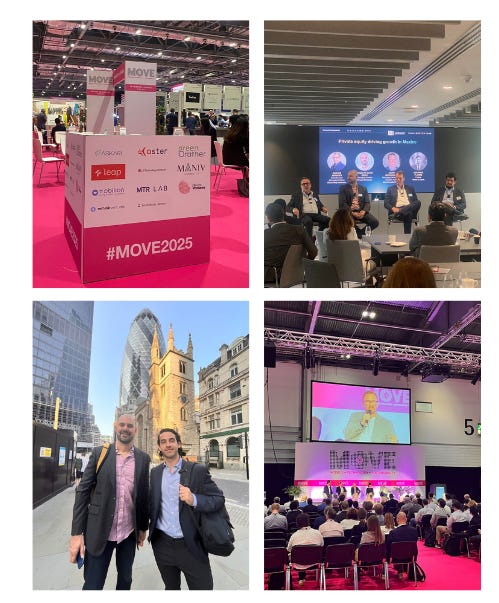

Last week in London, we took part in two major events shaping global innovation: MOVE London 2025 and AMEXCAP EU.

At MOVE London, we explored cutting-edge advancements in EV infrastructure, autonomous systems, and AI-powered logistics. With 6,000+ attendees and hundreds of startups, it remains one of the world’s most important stages for mobility innovation.

Meanwhile, at AMEXCAP EU, the mission was clear: position Mexico as a prime destination for international investment. Our Managing Partner, Rodolfo Dieck, joined a panel to discuss the venture capital and private equity landscape in Mexico — highlighting the country’s strong fundamentals, underpenetrated capital markets, and the vast investment opportunities that make it especially attractive to international investors.

Two events. One city. One clear message: the future of mobility is global — and Mexico is ready to lead.

🏆 Our PortCos News

🔌Smart Charging Just Got Smarter – Congrats to Deftpower and Kuster Energy!

We’re thrilled to see Kuster Energy now enabling smart charging across its public charging stations, powered by Deftpower’s cutting-edge technology. Thanks to this integration, EV drivers using smart charge cards—such as those from ANWB—can now charge more affordably, reduce CO₂ emissions, and support grid stability automatically, with no extra effort. A big shout-out to the Deftpower team for making this partnership possible. It’s another strong step toward building a more flexible, future-ready charging network—smart for the driver, smart for the grid.

🔗 Learn more: https://lnkd.in/emVqKfPm

⚡ Another Step Toward the Future of EV Charging with Electric Era

Electric Era just set a new benchmark for EV infrastructure by installing a DC fast-charging station at a Costco in North Port, Florida — in just 54 days from groundbreaking to launch. The site includes six ultra-fast charging stalls (three CCS and three Tesla-compatible NACS connectors), each delivering 200 kW, and is powered by Electric Era’s proprietary energy management system with on-site battery storage. This tech not only reduces grid upgrade requirements but also slashes permitting times, enabling rapid deployment at scale. With over 20 sites already operational or near completion and 30 more in development, Electric Era is proving that fast-charging infrastructure can keep pace with EV adoption.

🔗 Learn more here

🤖 AI Meets Logistics: Solvento at ConaLog 2025

Last week, Solvento joined top industry leaders at the ConaLog 2025 Logistics & Supply Chain Directors Dinner, where AI’s role in reshaping Latin America’s logistics took center stage.

Jaime Tabachnik, Solvento’s CEO, spoke alongside Enrique Vázquez (Recurso Confiable América) on how AI is transforming operations and building smarter, more resilient supply chains. The evening also featured an inspiring keynote by David Ruiz, Head of AI & Data Analytics at Google.

👉 For more updates on how logistics leaders are driving innovation in the region, check out Solvento’s website.

⚡ Trucks That Power the Economy — Now Powering the Grid

In a new partnership with Leap, Xos is enabling its electrified fleet customers to participate in grid services through Leap’s virtual power plant (VPP) platform. This collaboration combines Xos’s mobile charging innovation with Leap’s demand response technology to unlock new revenue streams for fleet owners — all while supporting California’s grid during periods of peak stress.

Why it matters: Lower infrastructure ownership costs, New revenue through grid participation, Faster path to electrification and Climate resilience through VPP integration. It’s a win for fleet operators, the grid, and the planet.

👉 Learn more here.

🚍 BusUp Hits 20 Million Rides!

Huge congratulations to our portfolio company BusUp on reaching 20 million rides — a major milestone in smarter, more sustainable commuting. This achievement reflects the dedication of their team, the trust of clients and partners, and the daily choice of millions of riders moving toward a more efficient future. Next stop: 50 million!

📯 Hot Deals

🚀 Auto Acquire AI, a Florida-based startup “set to disrupt the vehicle acquisition software business and the traditional used-car inventory supply chain standards,” raised $4 million in funding. (16.Jun.2025)

🚀 Circular Brain, a Brazilian startup that connects collection centers, transporters, dismantlers, and recyclers to help electronics manufacturers meet waste compliance laws using traceable, certified credits raised $3.5 million from Lorene Urban Mining. (28.May.2025)

🚀 Clear Current, an Albuquerque startup that helps businesses track and control their energy use with AI, aiming to cut waste and improve efficiency, raised a $4 million seed round led by Rho Ignition, with Coreline Ventures and Avesta Fund also chiming in. (27.May.2025)

🚀 Coco, a Los Angeles startup that is building last-mile delivery robots, raised $80 million round. Investors included DeepWater, Outlander, and SNR as well as previous investors Sam Altman, Max Altman, Pelion Venture Partners, and Offline Ventures. The company has raised a total of $120+ million. (10.Jun.2025)

🚀 Crabi, a Mexico-based digital car insurance company raised $13.6 million round led by Kaszek and Ignia with participation from 30N Ventures, Redwood Ventures, Carao Ventures and others. (05.Jun.2025)

🚀 Daybreak, a San Francisco-based supply chain planning AI platform, raised $15 million in Series A funding from TPG Growth and Dell Technologies Capital. (10.Jun.2025)

🚀 Engrate, a Swedish startup simplifying digital integration in the energy sector raised €2.5 million round led by Maniv with participation from Enviny Ventures and Sweden’s Course Corrected. (12.Jun.2025)

🚀 Gridcare, a Redwood City, CA., grid capacity platform raised $13.3 million in seed funding led by Xora with participation from Acclimate Ventures, Aina Climate AI Ventures, WovenEarth and others. (27.May.2025)

🚀 Justos, a São Paulo-based auto insurance company, raised $16.5 million in funding. Ribbit Capital led the round and was joined by Kaszek, Endeavor Catalyst, and Scale-Up Ventures. (19.Jun.2025)

🚀 Kargo, a San Francisco, CA-based industrial artificial intelligence (AI) technology company, raised $18.4M in funding led by Matter Venture Partners, with participation from previous investors Sozo Ventures and Founders Fund. (06.Jun.2025)

🚀 LuminX, a San Francisco startup that is developing AI vision models to improve warehouse operations and logistics efficiency, raised a $5.5 million seed round. Investors included 1Sharpe, GTMFund, 9Yards, Chingona Ventures, and Bond Fund. (03.Jun.2025)

🚀 Manex, a Munich-based AI-driven quality management software for industrial customers, has raised €8m in seed capital led by Lightspeed and Blue Yard Capital. (03.Jun.2025)

🚀 MesoMat, a Canadian startup that installs tire sensors and cloud software for fleet operators to track things like pressure, fuel impact, temperature, and leaks in real-time, raised a round of an undisclosed amount led by Ridgeline, with participation from RISC Capital, RPV Global, and Extra Innings Ventures. (11.Jun.2025)

🚀 Obvio, a San Francisco AI-driven traffic safety startup raised a $22 million Series A led by Bain Capital Ventures with additional investors Khosla Ventures and Pathlight Ventures. (04.Jun.2025)

🚀 Parkade, a San Francisco-based proptech startup raised $10 million in Series A funding to scale its parking management platform. The round was led by Navitas Capital. (19.Jun.2025)

🚀 Piston, a Cupertino, Calif.-based cardless payments platform for commercial fleets and gas stations, raised $6.1 million in seed funding. Spark Capital led the round and was joined by Pear VC and BOND. (11.Jun.2025)

🚀 Q5D, a UK startup that builds robotic systems that automate the assembly of wiring harnesses for vehicle manufacturers and their parts suppliers, raised a $10.9 million Series A round co-led by Lockheed Martin Ventures, Chrysalix, and Maven SWIF, with SOSV, UKI2S, UntroD, and CPI Enterprises also opting in. (10.Jun.2025)

🚀 Rhino, a Brazilian startup offering secure rides in armored hybrid and electric vehicles, raised $1M in a round led by AngelsDeck Global Ventures and Clapper Venture. (05.Jun.2025)

🚀 Rhizome, a Washington, DC., climate grid planning software raised $6.5 million in seed funding led by Base10 partners. (21.May.2025)

🚀 Riico, a German startup that uses AI to convert factory scan data into fully segmented, CAD‑ready 3D digital twins for engineering teams, raised a $5 million seed round led by Pi Labs, with Seed+speed Ventures, WaVe-X, Earlybird Venture Capital, and Volvo Cars Tech Fund also participating. (12.Jun.2025)

🚀 RockED, a Florida-based people development platform for the automotive industry announced an investment from FM Capital. (04.Jun.2025)

🚀 Secro, a Charleston, US., AI-enabled platform for global trade finance replacing paper-based processes with secure, intelligent workflow automation and digitalization announced a $10 million Series A funding round led by Assembly Ventures and Sway Ventures with participation from other strategic partners. (23.May.2025)

🚀 Senra Systems, a Torrance, CA, that builds robotic manufacturing equipment designed to automate the production of large, complex metal parts for aerospace, energy, and industrial companies, raised a $25 million Series A round co-led by Dylan Field andCIV, with 8VC and Pax as well as previous investors General Catalyst, Sequoia Capital, Founders Fund, and Andreessen Horowitz also opting in. (18.Jun.2025)

🚀 SWTCH Energy, a Boston-based electric vehicle charging solutions company, raised $4 million in funding from Constellation Technology Ventures. (05.Jun.2025)

🚀 Toma, a San Francisco retail auto technology startup raised $17 million from investors, including Holman Automotive Group. (05.Jun.2025)

🚀 Tradeverifyd, a Bozeman, Mont., supply chain risk management platform designed to help enterprises identify, assess, and mitigate risks secured $4 million in new funding from SJF Ventures. (21.May.2025)

🚀 Umob, a Rotterdam-based booking platform which combines local and international mobility providers in one single app, announced today they raised €3.5 million in a new funding round. (17.Jun.2025)

🚀 Volteras, a London startup that builds data streaming tools for the electric vehicle industry to help developers and operators manage energy and mobility services, raised an $11.1 million Series A round led by Union Square Ventures, with Exor and Long Journey Ventures also opting in. (29.May.2025)

🚀 Voltfang, a German startup that repurposes used EV batteries into large-scale energy storage systems for businesses and utilities to manage power use and stabilize the grid, raised a $17.2 million Series B round led by prior backer ForwardOne, with Fiege Ventures and Newberry Investments. (12.Jun.2025)

🚀 Warp, a New York startup that operates a tech-driven logistics network that uses AI and robotics to plan routes, manage cross-docks, and move shipments efficiently between warehouses and carriers, raised a $10 million Series A round. UpPartners and Blue Bear Capital were the co-leads. (16.Jun.2025)

📗 Interesting Reads

From Ownership to Access: How Automotive-as-a-Service Is Driving the Future of Mobility

The Automotive-as-a-Service (AaaS) market is on track to grow from $37 billion in 2024 to $92 billion by 2034, fueled by rapid urbanization, evolving consumer preferences, and the rise of digital, flexible mobility models. AaaS includes ride-hailing, car-sharing, rentals, and subscription services — all reflecting a shift from ownership to access.

This growth is supported by advances in EVs, autonomous tech, and integrated platforms that make mobility seamless. Europe currently leads with 18% of the market, but regions like North America and Asia-Pacific are catching up fast. Challenges remain — from regulatory fragmentation to fierce competition — but the direction is clear: flexible, tech-enabled, and customer-centric mobility is the future. We’re just at the beginning of this transformation — and there’s a lot more to learn as cities evolve, business models mature, and partnerships between OEMs, tech companies, and governments deepen.

At Proeza Ventures, we see Automotive-as-a-Service (AaaS) as more than a market trend — it’s a structural shift in how people move, driven by the demand for flexibility, efficiency, and digital-first experiences. As EV adoption, autonomous tech, and platform-based models mature, AaaS will play a central role in making mobility more sustainable and accessible. The road ahead may have challenges, but the momentum is clear — and we’re investing in the models shaping that future.

👉 Check the full note here.

📈 The IPO Market Reawakens with Infrastructure and Crypto at the Forefront

After a long freeze, the IPO market is showing definitive signs of revival — led not by traditional software giants, but by companies operating at the infrastructure edge: CoreWeave and Circle. CoreWeave, a GPU cloud provider, went public in March 2025, raising $1.5B at a $20B valuation and seeing its stock surge over 300%, driven by 420% YoY revenue growth, nearing $1B in Q1 alone. Circle, issuer of the USDC stablecoin, followed with a blockbuster IPO on June 5, jumping 168% on day one, and surpassing an $18B market cap. These listings reflect renewed investor appetite for category-defining businesses in emerging, once-volatile sectors like crypto infrastructure and data center tech. More broadly, this marks a genuine reopening of the IPO window, fueled by strong demand despite macroeconomic uncertainty. Paired with a resurgence in M&A activity, the back half of 2025 is shaping up to be a high-liquidity environment for tech growth stories.

At Proeza Ventures, we see the resurgence of the IPO market — led by infrastructure-first companies — as a strong signal that investors are prioritizing scalability, real revenue, and foundational technologies over hype. This shift underscores a broader trend: category-defining businesses at the edge of AI, crypto, and cloud infrastructure are commanding attention because they power what’s next. With M&A activity also picking up, the second half of 2025 is shaping up to be a more liquid, opportunity-rich environment — especially for startups solving critical, capital-intensive challenges.

👉 Check the full note here.

🌱 Opportunities in Mobility

👩🏻💻Grants & GIS Associate - Electric Era

👩🏻💻Account Lead - Electric Era

👩🏻💻Product Marketing Manager - Electric Era

👩🏻💻Head of Marketing - Electric Era

👩🏻💻Senior Embedded software Engineer - Electric Era

👩🏻💻EV charging development program Manager- Electric Era

👩🏻💻Electrical Engineer- Electric Era

👩🏻💻Senior Key Account & Ops Manger - BusUp

👩🏻💻Business Development Executive - BusUp

👩🏻💻Customer Success Executive Lead - BusUp

👩🏻💻Sales Development Intership - BusUp

👩🏻💻Providers Executive - BusUp

👩🏻💻Field Service Technician - Xos

👩🏻💻Director of Accounting - Xos

👩🏻💻EV Charging Account Executive - Xos

👩🏻💻Staff Software Engineer - Ridepanda

👩🏻💻Bicycle Mechanic - Ridepanda

👩🏻💻Head of Engineering - Ridepanda

👩🏻💻Operations Manager - Ridepanda

👩🏻💻Account Executive - Ridepanda

That's it for this month!

Don't forget to subscribe or forward The Paddock to your friends in the mobility sector! 🏍️💨